How to Lose Money in the Stock Market

May 27, 2020

So my cousin asked me for stock tips so that he can start making money in high school. Here is my origin story and a prayer that he will be wise enough to learn from my mistakes. “Those who do not learn history are doomed to repeat it.”

My Humble Beginnings

When I first started investing, I just wanted to make a bunch of money through investing in stocks. So I started reading books by Peter Lynch and going to the Caltech stock investing club. However, I soon realized that making money in the stock market was not that easy.

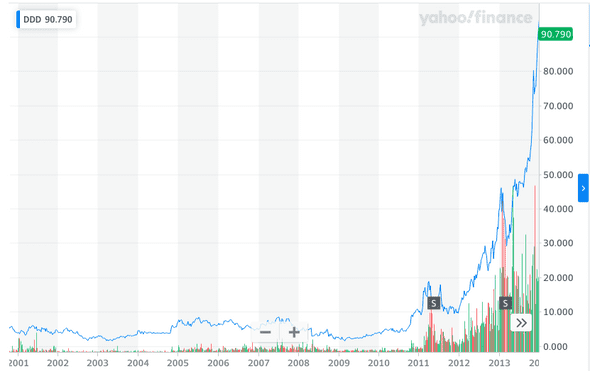

During my first visit to the Caltech investment club, I proposed buying shares of a 3D printing stock. I had found this stock about a year and a half earlier during a high school stock market competition and it had skyrocketed from under $20 to over $90.

I was working at Caltech for a summer internship and we were using 3D printing in our laboratory and I had used 3D printing in all of my previous internships as well. In the future, without a doubt, more and more products would be created using 3D printing. The board voted on whether to buy this stock and it passed with 4 people in favor and 1 person abstaining from voting and so the president invested just over $10,000 into this stock the next day.

Before we bought, it had already dropped 10% so I figured that we were getting a good deal. I continued attending the Caltech investment club meetings and each week it continued to drop. By the time we sold it I had stopped attending the club and our “investment” had lost over $8,000. (No wonder Caltech tuition is so high!)

Lessons Learned

So what did we learn from my spectacular investing origins?

- When learning to invest in the stock market, the best money to use is someone else’s money. I lost over 80% of my investment in the stock market without losing a penny (although I did gain some pounds from the deliciously greasy food at the meetings).

Although you may not have the same opportunity that I had, there are some websites that allow you to practice with fake money. Just remember that you will also have to pay taxes and fees in real life!

- Just because a company is X% off from it’s all time high does not mean that is actually on sale relative to it’s value. We never did any fundamental analysis on the company nor its competitors and thus we were purely speculating.

Take care to do proper research and create an argument for why a company is undervalued so that you are not speculating based on market trends. Otherwise, you may just catch a falling knife [1].

-

Even smart, experienced investors can be fooled by hype and trends and the herd mentality. 3D printing was hot at the time and is still becoming more popular. But in retrospect, nowadays investors consider that stock way overvalued since it’s worth less than 10% of it’s all time high of $95 today. In order to invest wisely, you must recognize the psychological demons and face your own worse enemy - the face in the mirror.

-

Finally, it is much harder to make money than to lose money. Gaining 80% would not have made up for the 80% that we had lost. Assuming we had sold at $2,000, if we made 80% on our next investment, that $2,000 would have grown to $3,600 which is still far off from the $10,000 we had originally started from.

“Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1.” - Warren Buffett

In retrospect, this was the best possible way for me to have started my investing career. While some others may get lucky and make money on their first speculations, I was fortunate enough to lose and lose big. Even though this was not my money, it was a big enough chunk of change for me to take these lessons to heart. In addition, this experience jump-started my years learning about personal finance and investing and finding a better way to invest.