So You Want to Learn about Investing

May 25, 2020

So my cousin asked me for stock tips so that he can start making money in high school. Here is my advice for him.

Dear Cuz,

First off, congratulations on becoming interested in stock investing early. Albert Einstein once said that “Compound interest is the eighth wonder of the world.”

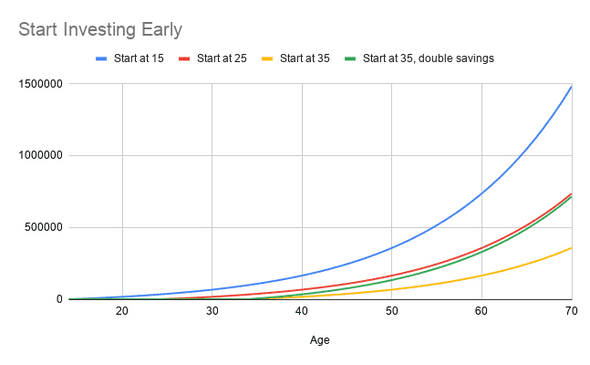

Example of the Magic of Compound Interest

At a 7% return, investing $200 per month from when you are 15 would get you to $1.48 million by the time you were 70. If you delay until you are 25, you would end up with less than half ($736 thousand). If you wait until you are 35, even if you put in double the money per month, you would end up with only $714 thousand.

Also note that in the case that you start at 35 and put in $400 per month, you would have had to invest $172,800 while by starting at 15, you not only invested less ($134,400), but also ended up with over twice the money.

Before You Start Investing in the Stock Market

Before you start investing, you need to set a SMART goal. Here are some examples:

- Have a net worth of $X by Y age.

- Become financially independent by Y age. (Being financially independent means making enough money passively to never have to work again for money and maintain your standard of living for the rest of your life.)

- Generate $X of income every month.

Why do you need a specific, measurable goal you ask?

The reason is that there are many different strategies for investing in the stock market and each strategy is catered towards a different goal. In fact, depending on your goal, stock market investing may not be the best strategy for you. Starting your own business or investing in real estate or another asset class might be better fit for you and your goals since you may be able to put a little more “sweat equity” (hard work) instead of money to make more money.

When I started researching, I just wanted to make money fast. By the way, the stock market is not ideal for this goal. I will dive more into this next.

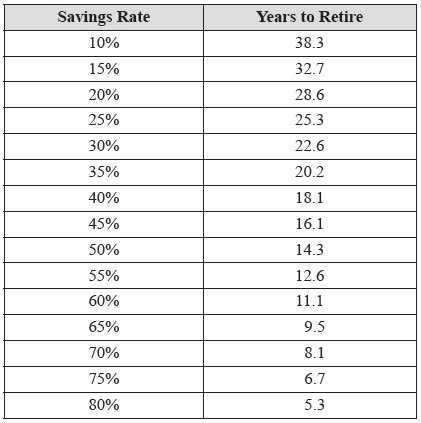

During one of my first internships, I was playing with a retirement calculator and decided to calculate how to retire as early as possible. After a ton of reading, I learned that the best way to do this was to focus on increasing my income, save a high percentage of my income, and invest the difference in a total stock market index fund. I was feeling burned out from school and work at the time so my first specific goal was to be financially independent (aka ready to retire) by the time I was 30. Although stock market investing did play into this plan, earning more and saving less were much more important to focus on.

Here is a chart from Mr. JL Collins’ website which he got from the Can I Retire Yet book. Assumes an 8% annual investment return and a 4% withdrawal rate.

Write Down That Goal

So your first step in your investment journey is to write down that specific goal. Feel free to take some time to brainstorm and write down some ideas. This goal does not have to be set in stone yet and can change over time. But having a goal will give you direction so that you can course-correct later on instead of sailing aimlessly.

Napoleon Hill in his famous book, Think and Grow Rich, even suggests writing your goal down and repeating the goal and visualizing when you get up in the morning and before going to sleep at night. Although it may sound strange, this is a book and technique that many successful entrepreneurs swear by.

Next time: My First Time Stock Investing